The Future of

Unified Commerce

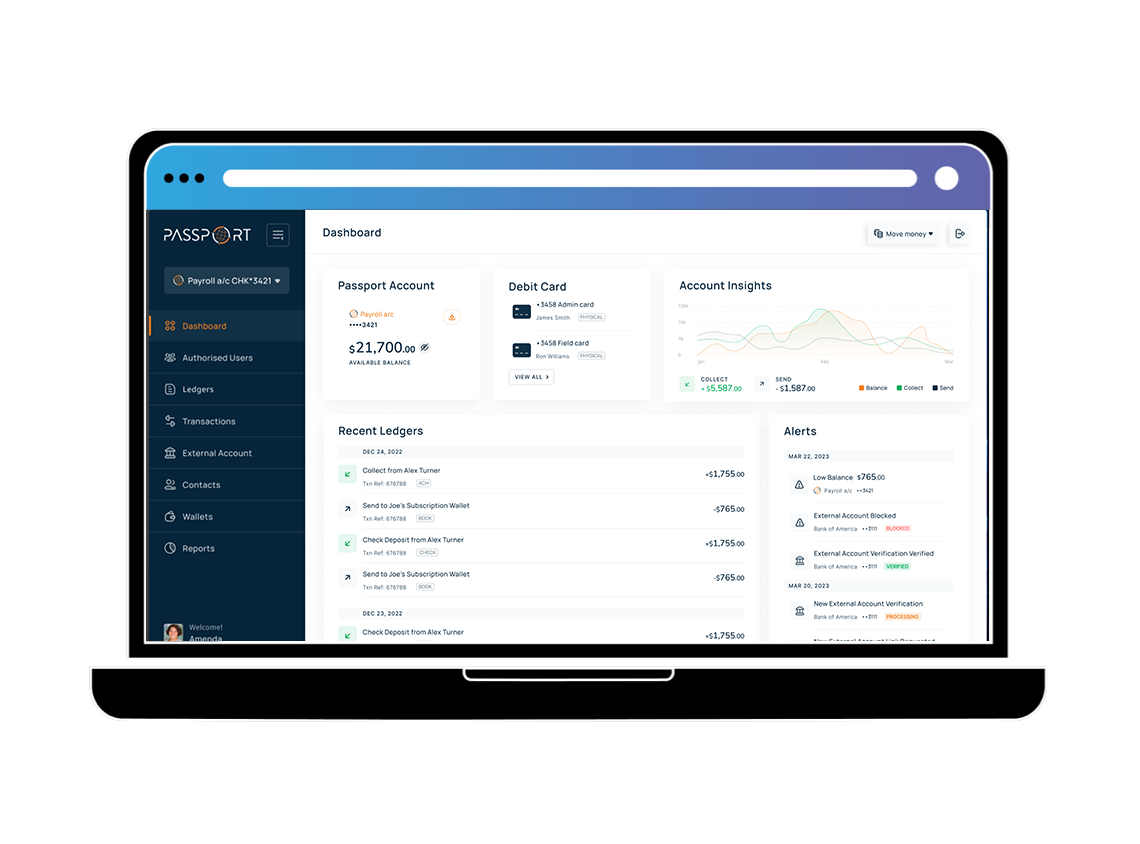

Welcome to integrated payments and banking solutions that allow companies to collect, store and send money on a scalable native platform – the only one of its kind in the industry. With Priority, there are none of the risks associated with cobbled together solutions, meaning transactions are faster, cash flow is accelerated, and implementation is quick and easy. Our advanced platforms and expertise make Priority the best value in the business.

Plastiq Pay is the payables management software that puts the power of any credit card you choose to work for your business. Inventory, leases, taxes, insurance… virtually any expense can be paid with a credit card, even if they don’t accept credit cards. Plastiq pays your vendor immediately by check, wire transfer or ACH, so you can better leverage working capital and earn card rewards for every payment.

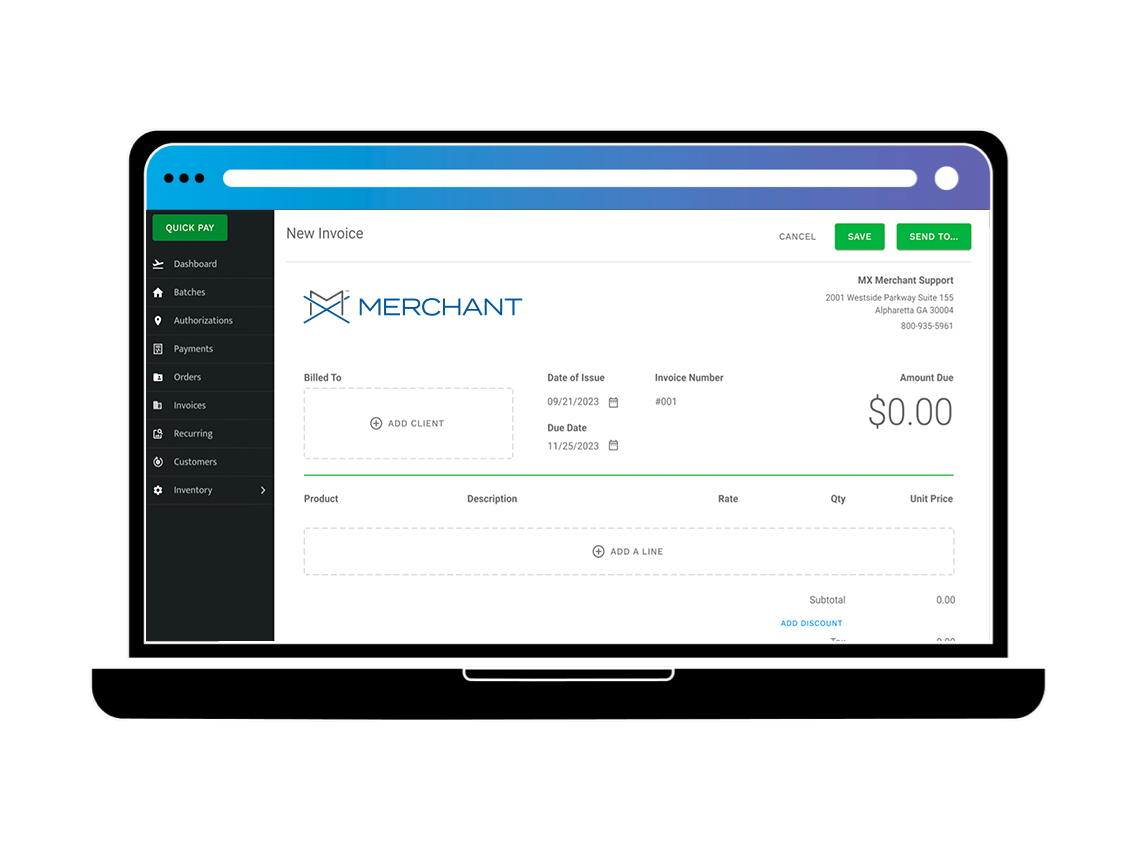

From small- and medium-sized businesses, virtually any size merchant can boost efficiencies with our powerful payment options.

We automate 100% of your accounts payable to reduce cost and generate cash back when paying your suppliers. Our integrated payables solution turns your cost center into a profit center.

Modernize legacy platforms or monetize payments with our leading-edge embedded payment and banking solutions.